Texas Inventory Tax Rate 2025. From property taxes to sales taxes and everything in. Is there a federal inventory tax?

A ustin (kamr/kcit) — texas comptroller glenn hegar released the state’s total sales tax revenue for february 2025 in a report on march 1. Your effective tax rate for 2025 is the sum of:

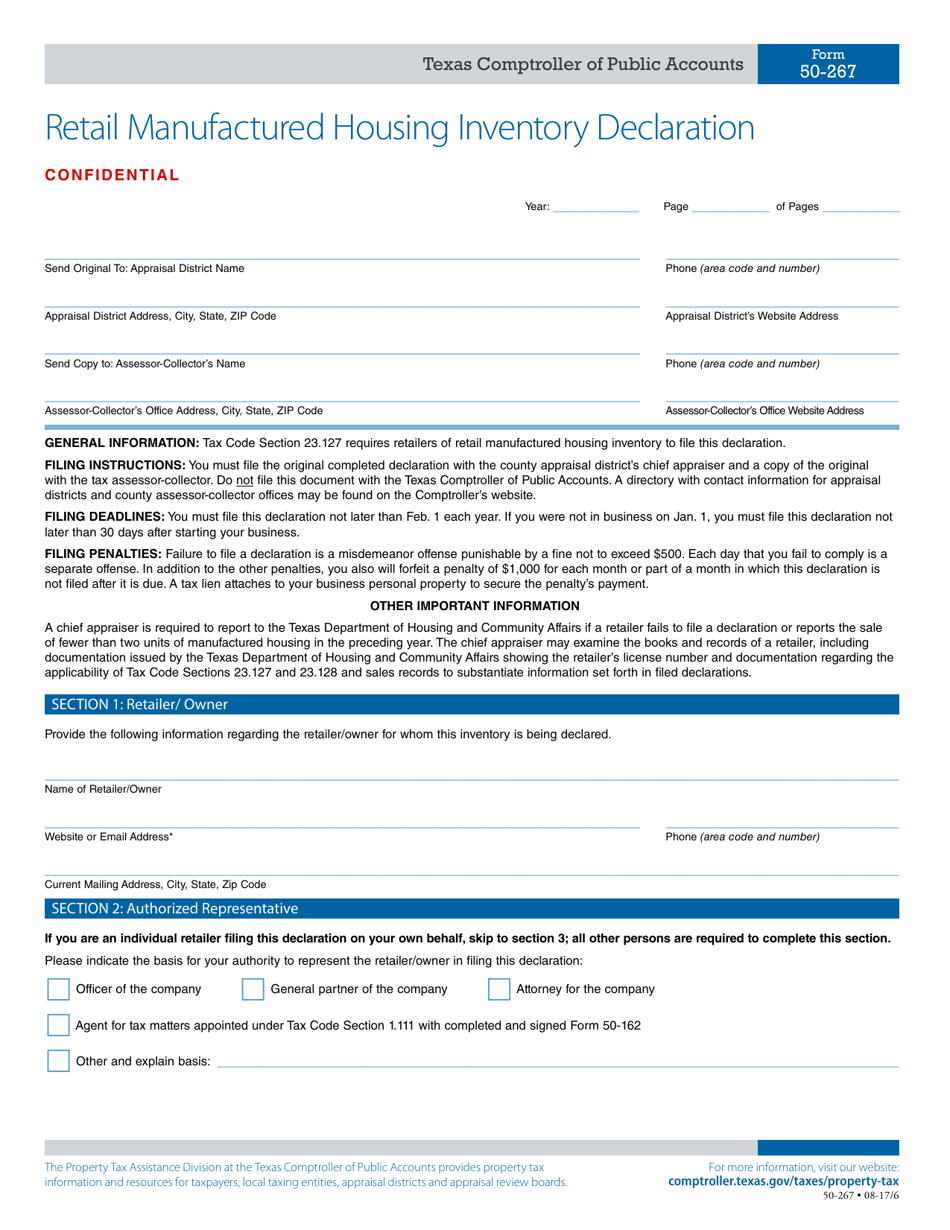

Form 50267 Fill Out, Sign Online and Download Fillable PDF, Texas, Tax year 2025 tax calculation. Your effective tax rate for 2025 is the sum of:

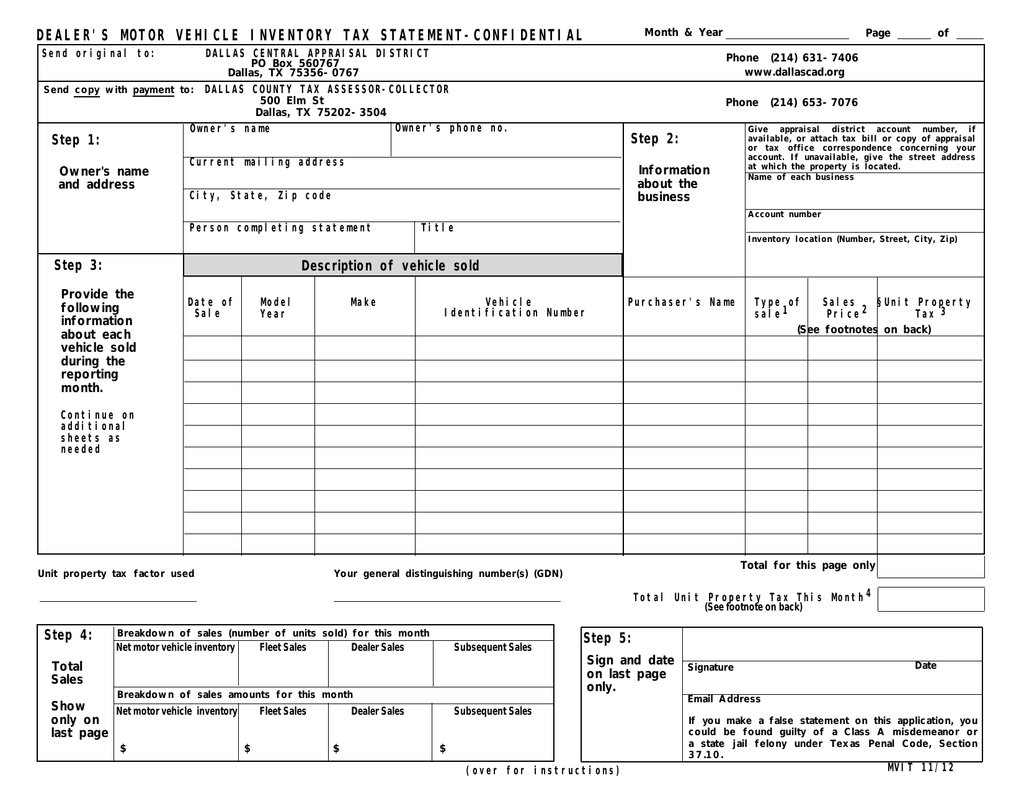

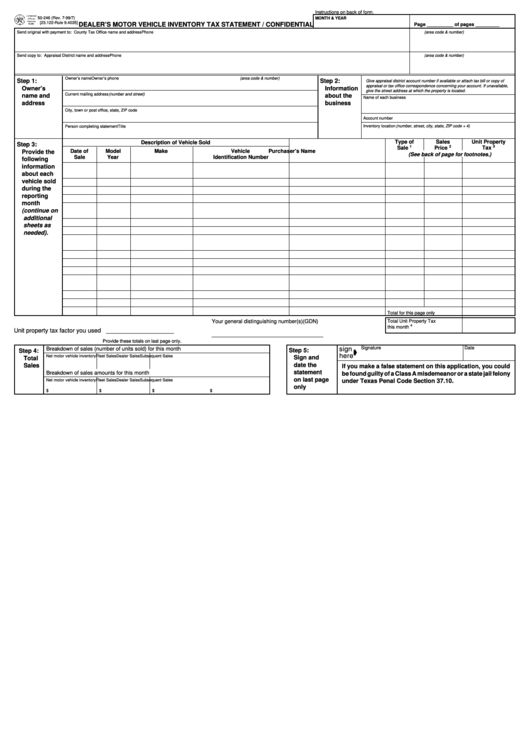

dealer`s motor vehicle inventory tax statement, Learn about exemptions and strategies for minimizing liabilities. Lowest sales tax (6.25%) highest sales tax (8.25%) texas sales tax:

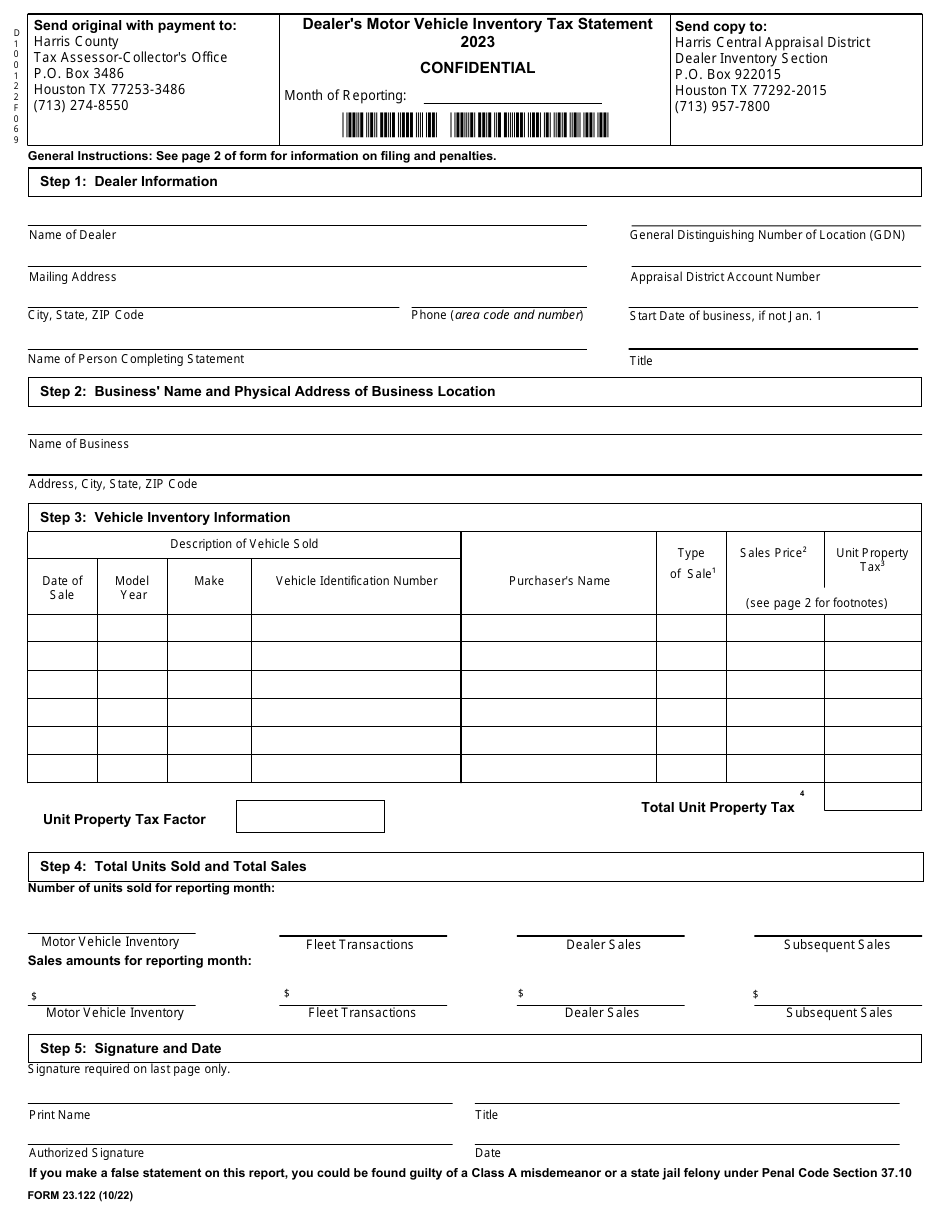

Form 23.122 Download Fillable PDF or Fill Online Dealer's Motor Vehicle, Texas has a 6.25 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 8.20 percent. May 25, 2025 | accounting & tax planning, blog.

Tax payment Which states have no tax Marca, Texas has a 6.25 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 8.20 percent. Up to 2% sales and use tax:

Bill written to end Texas inventory tax NBC 5 DallasFort Worth, Your effective tax rate for 2025 is the sum of: Texas base sales tax rate:

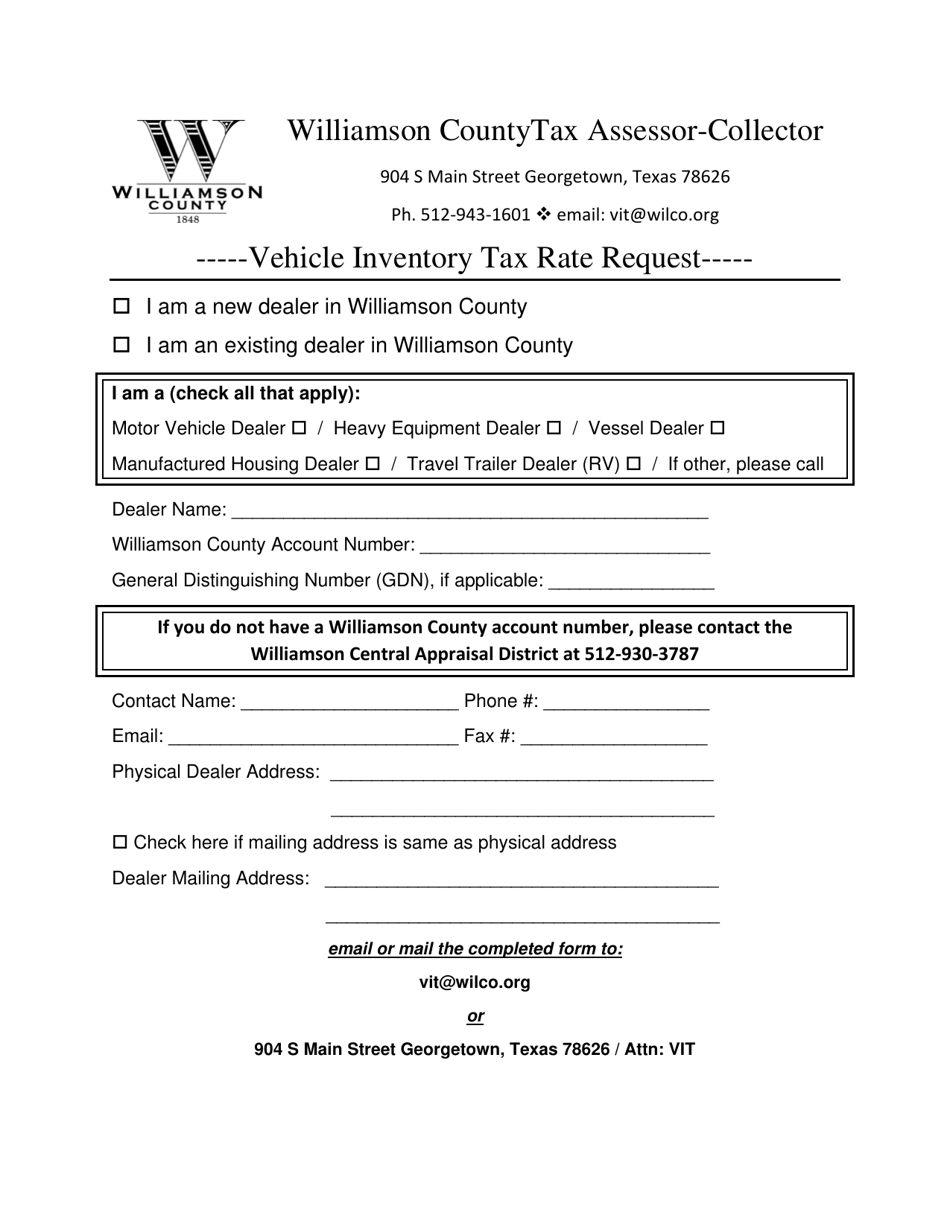

Williamson County, Texas Vehicle Inventory Tax Rate Request Fill Out, Average sales tax (with local): Value), 23.124 (dealer’s vessel and outboard.

Tax rates for the 2025 year of assessment Just One Lap, Learn about exemptions and strategies for minimizing liabilities. 2025 list of texas local sales tax rates.

Top Form 50246 Templates free to download in PDF format, Five year t a x rate history. Tax rate fiscal year 2025 / 2025.

State and Local Sales Tax Rates, Midyear 2025, Texas lawmakers will have their hands full with a variety of topics during the new legislative session and among them is a plea from the state's businesses for some relief from an inventory tax. Texas has a 6.25 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 8.20 percent.

2025 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, We’ll tell you everything you need to know about sales tax in texas (tx) in our 2025 texas sales tax guide. Texas has a 6.25 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 8.20 percent.

Graduation Suits For Guys 2025. Cool graduation outfits for guys that will make you stand out at your graduation. Graduation…

Abc News Made In America December 12 2025. ‘world news tonight’ shares gift ideas that. During his address, the president…

Michigan Hockey Recruits 2025. Roster outlook for michigan state spartans. Beyond davis, the michigan wolverines are hosting a number of…